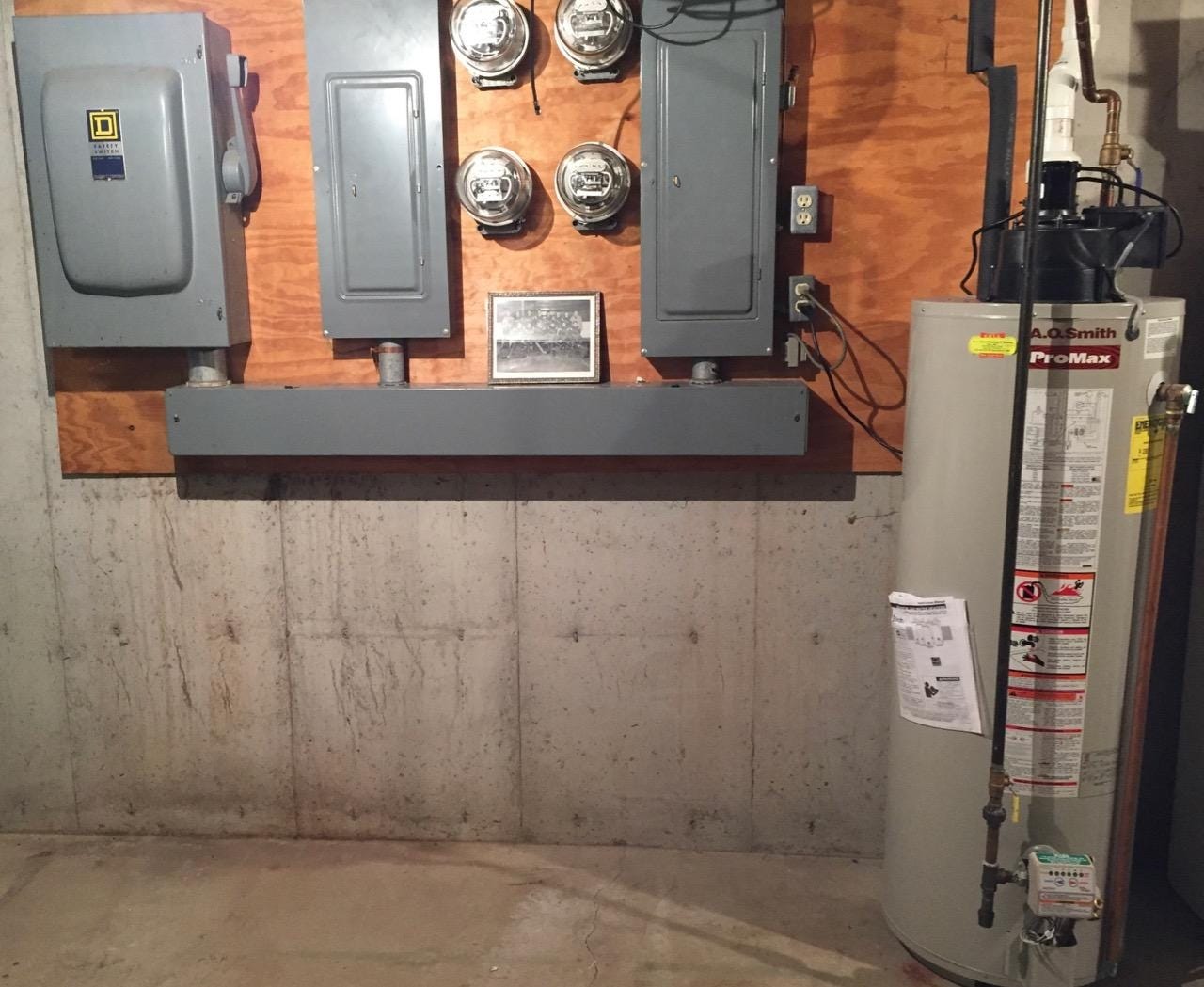

![A home warranty can give you piece of mind, but not all states treat home warranties the same. [Photo courtesty of Richard Montgomery]](http://127.0.0.1/wordpress/wp-content/uploads/2022/01/ghows-DA-70bb0fdf-93e7-1ec8-e053-0100007f398a-43538738.jpeg)

Reader Question: We are buying a home, and the agent suggested a home warranty to replace or repair things that wear out. The warranty covers such items for a year, after which time we can renew the contract or let it lapse. The cost of the coverage is over $400. We have asked people we know and the reviews from them range from it is a waste of money to a good idea. What is your opinion?

Monty’s Answer: Home warranty contracts have been available for over 50 years. The experience gained over this period has allowed the providers, of which there are many, to tweak the language in their agreements to avoid misunderstandings with customers and also enable the industry to prevent excessive financial exposure.

While home warranties are very different from home inspections, both business models operate on a certain degree of subjectivity, which leads to controversial interpretations. Interestingly, neither business model offers a warranty. A bad experience shapes opinions.

On the other hand, many customers stand by the product as worthwhile. There are many instances where a home warranty provided peace of mind and cost savings for the owner of the contract. Some home components are quite expensive, and the cost of parts and technicians on service calls can add up quickly.

Considerations in buying a home warranty

— All home warranty companies are not equal. The contract language varies, they have different exclusions and coverage, they judge repair or replace differently, and the management of customer service departments is not the same. Do not expect a new furnace if the current one can be repaired. Be cautious in Internet searches for paid ads that rank companies by the cost of their ad.

— Understand that you are buying a service contract and not a warranty. The name home warranty is part of the industry’s problem because the very name promotes it as a warranty. State regulators do not agree from state to state whether a home warranty is an insurance policy. According to the National Home Service Contract Association (NHSCA), some states do not classify home service contracts as insurance. Neither Ohio, nor Pennsylvania, and others, consider a service contract insurance. The state of Wisconsin, as one of many, does regulate home service contracts through the Office of the Commissioner of Insurance. Consider checking whether or not your state’s insurance regulators watch over home service contracts. Insurance regulators may have more influence or power when there are misunderstandings with business than universal consumer protection laws. The fear factor of a business hearing from an insurance regulator is just behind hearing from the IRS.

— Read the contracts yourself. You will be the one discussing your claim with the company if you have a claim. Do not ask your agent questions because they likely have not read the contract. If you have questions after you have read the agreement, you are better off calling or emailing the company with your questions. Email is the superior method if that option is available because you do not have to take notes; those email responses are superior to your notes if there is a future claim. Compare coverage in what appear to be your top three choices. For example, how far does the plumbing coverage go if you have well and septic systems? Are there deductibles? What doesn’t the policy cover?

— Consider the property. In a general sense, the age of a home is a prime consideration. With use and time, most components of a home wear out, discolor or become brittle. This example may be an exaggeration, but if the house is 100-years-old and the appliances are 50-years-old, a warranty could likely be an asset. If the home is well constructed and less than 10-years-old, think about how far the $400 service contract will take you if an appliance fails. Has the kitchen or bathrooms in an older home undergone renovation?

— Start a fund. Start with the cost of the home warranty and add each month to build a reserve. Here is an article at https://dearmonty.com/costs-home-maintenance/that discusses how this method might work.

— Personal considerations. For example, if you are not handy and do not like the idea of vetting contractors if something breaks down, a home warranty may be very appealing. Will you be remodeling? Many consumers believe never having a claim is the best result of buying a home warranty.

Richard Montgomery is the author of "House Money – An Insider’s Secrets to Saving Thousands When You Buy or Sell a Home." He is a real estate industry veteran who advocates industry reform and offers readers unbiased real estate advice. Ask him questions at DearMonty.com.

This article originally appeared on Santa Rosa Press Gazette: 6 tips when buying a home warranty